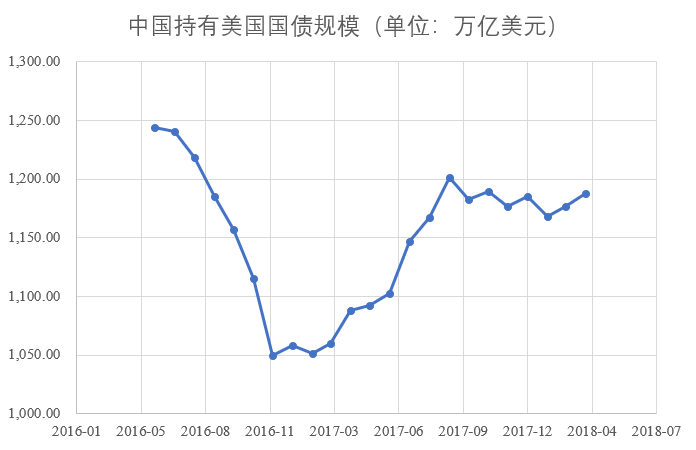

According to data released by the US Treasury on May 15, the size of US Treasury bonds held by China in March 2018 increased by 11 billion U.S. dollars, and the total size increased to 1.19 trillion U.S. dollars to a five-month high. With the release of the April retail sales data expected by the supermarket, the US bond yield rose to 3.089%, a record high in seven years. US bond yields boosted the US dollar index sharply, while the US stock market was under pressure again. Analysts believe that the rise in inflation expectations and the increase in the maturity of the national debt supply are the main reasons for the continued rise in US bond yields since the beginning of the year. Subject to the rise in US bond yields, Chinese government bond futures weakened in early trading on the 16th. UBS, a fixed-income fund manager of UBS, told reporters that the average spread between China and the US in the 10-year period is around 100-120 basis points. The current narrowing of the spread has certain restrictions on the rise of China's bond market. The government bond yield center will remain at 3.7%. China's US debt holdings rose Under the Sino-US trade dispute, whether China will substantially reduce its holdings of US debt once became the focus of the market. On May 15, the US Treasury Department released data showing that the size of US Treasury bonds held by China in March 2018 increased by 11 billion U.S. dollars, and the total size increased to 1.19 trillion U.S. dollars, a five-month high. Japan’s US Treasury holdings in March reported a size of US$1.04 trillion, a decrease of US$16 billion from the previous month to a new low since 2012. On the same day, data released by the US Department of Commerce showed that US retail sales in April increased by 0.3% from the previous month, rising for two consecutive months, and the previous value was revised from 0.6% to 0.8%. After the release of the data, the yield of US Treasury bonds rose linearly. The yield of US 10-year government bonds rose to 3.089%, a record high since 2011. Other term varieties also rose upwards. The 2-year and 5-year US Treasury yields were respectively It rose by 2.5 basis points and 5.6 basis points. As of press time, the 10-year US bond yields have slightly adjusted back to the 3.06% line. The US bond yields boosted the US dollar significantly, and the US dollar index climbed to 93.44, completely recovering the lost land during the year, hitting a new high since December 2017. After the US bond yields rose strongly, the US stock market was under pressure again. The Dow Jones index fell nearly 200 points on Tuesday, ending the previous eight-day rise. The S&P 500 index closed down 0.68% to 2171.45 points; the Nasdaq Composite Index closed down 0.81% to 7351.63 points; the Dow Jones Industrial Average closed down 0.78% to 24,706.41 points. Why is the yield of US bonds rising? In fact, since the beginning of the year, the yield of US Treasury bonds has been showing a continuous and rapid upward trend. The 10-year US Treasury yield has risen continuously from 2.4%, and the cumulative increase has exceeded 60 basis points. E Yongkang, chief financial analyst of the Bank of China Financial Research Center, told reporters that the rise in interest rate hike is not the main reason. The rise in inflation expectations is an important driving factor, but it is even more important to ignore the market expectation of government bonds. The impact of the increase in the term premium brought about by the increase in supply. First, in terms of interest rate hike expectations, historical experience shows that, under other conditions, the Fed’s interest rate hike will often lead to narrowing of the short-term and long-term government bond yields, while the 10-year US bond yields in April are obvious. The shorter the period and the smaller the increase, the longer the spread of the term and the steeper the yield curve. Therefore, the expected change in interest rate hikes is not the main driver of this round of US debt interest rates. Second, in terms of inflation expectations, since April, due to the geopolitical conflict in Syria, commodity prices, especially oil prices, have risen rapidly, which has triggered inflation expectations. But the change in inflation expectations is not the whole reason for the rise in nominal yields. The nominal government bond yield can be decomposed into the sum of the actual rate of return and the inflation expectation. According to the calculation, the contribution of the actual rate of return even exceeds the impact of inflation expectations. Third, the expectation of a significant increase in the supply of US debt is the main driving force behind the rise in the term premium. The change in real rate of return mainly reflects the impact of the term premium, while the expectation of a significant increase in the issuance of government bonds has led to an increase in the term premium. The US Congressional Budget Office released a report in April predicting that the US fiscal deficit will exceed $1 trillion by fiscal year 2020. E Yongjian also said that the US medium-term national debt is the main type of funds raised by the Ministry of Finance to issue bonds. In the future, the main varieties of government bonds issued will be mainly medium-term bonds, and the growth of medium-term government bonds will exceed short-term and long-term national bonds. In April, the real rate of return on 5-year and 7-year Treasury bonds increased relatively. Looking forward to the market outlook, whether there is still room for the US bond yields, Lou Chao told reporters that the market is currently waiting for the Fed to raise interest rates in June, and further judge the follow-up of the US debt after the interest rate rise. E Yongjian believes that the momentum of further increase in US bond interest rates in the short term may be insufficient, and the possibility of high level shocks is greater. It is expected that the probability of a 10-year US Treasury yield will fluctuate at the current high level, or there will be a small upside, but without a big shock, it is unlikely that further sharp increases will occur. China's government bond yields have limited downside Subject to the higher US dollar bond yields, the yield of Chinese government bonds has also risen. On May 16, treasury bond futures weakened significantly in the morning session. The 10-year bond contract T1806 fell 0.19%, and the 5-year bond TF1806 fell 0.16%. In the afternoon, the debt shocked and the 10-year bond contract T1806 closed up. 0.1%, the 5-year bond contract TF1806 rose 0.01%. In terms of coupons, the 10-year National Open Active Bond 180205 yield is up 1.74bp to 4.5525%, and the 10-year China Treasury Bond Active Bond 170008 yield is down 0.5bp to 3.750%. Along with the continued rise in the yield of US Treasury bonds and the fall in the interest rate of Chinese government bonds since the beginning of the year, the spread between China and the United States is also narrowing. Taking the 10-year Treasury bond as an example, the Sino-US spread has narrowed from the 140 basis points at the beginning of the year. Up to now 64 basis points. Looking back at history, Lou Chao told reporters that the average spread between China and the United States in the ten-year period is around 100-120 basis points. The narrowing of the spread between China and the United States has certain restrictions on the rise of China's bond market. In Lou Chao’s view, the overall interest rate of Chinese government bonds has declined since the beginning of the year. On the one hand, long-end interest rates have shown a high allocation value at the beginning of the year. On the other hand, liquidity has warmed, trade warfare factors and fundamentals Expected to bring a rebound in the bond market. However, he believes that in the future, China's bond market will be difficult to get out of the trend of the bull market, and will continue to show a range of fluctuations during the year. It is expected that China's 10-year bond yield center will remain at 3.7%.

A cutting board is a must-have item in the kitchen. Cutting vegetables, cutting fruits, etc. are all inseparable from a useful cutting board. Our cutting board is made of selected natural wood, moderately soft and hard, tough and thick; not easy to hurt the knife, not easy to deform, not easy to burst, easy to clean; simple in shape, beautiful and durable, it is a rare kitchen helper.

Kitchen Cut Board,Kitchen Cutting Board,Vegetable Cutter Board,Kitchen Chopping Boards JIANGMEN MEIAO KITCHEN AND BATH CO.,LTD , https://www.meiaogroups.com

Abstract According to data released by the US Treasury on May 15, the size of US Treasury bonds held by China in March 2018 increased by 11 billion U.S. dollars, and the total size increased to 1.19 trillion U.S. dollars to a five-month high. With the release of the April retail data expected by the hypermarket, the US bond yield...